Worldwide, economies are expected to get a hammer blow from the effect of Covid-19. In India also an economic contraction is inevitable. It is very challenging to estimate the level, given the uncertainty of how long the pandemic persists. Reliable data is hard to come by and the challenge is magnified in these unprecedented times due to the effects of the lockdown. Even where data is available, its application to compute Gross Value Added GDP using simulation models may be rendered statistically irrelevant because of the staggering range of the variation. While one hopes that the government has the resources to compute the numbers in a dynamic context, there has not been any substantive press releases with such details. Most of the reporting has thus been reliant on reports by investment banks with the inherent strengths and weaknesses of the simulation models the have use for sectoral GDP calculation. As these are mostly proprietary, they are not available for public scrutiny and without their analysis one can hardly comment on the accuracy of such forecasts. However, conclusions when published are used in India’s noisy and highly polarized politics to further political positions. They are reported in mainstream television media with headline grabbing bombast accompanied with selective usage of footage from real life stories that can be found to buttress as many points as there are humans. All this justifiably causes a great deal the angst amongst the populace. During such times of crisis, data-driven analysis should be the only way to assess the extent of the disaster as it is unfolding. It is precisely because of these reasons the authors have adopted a simplistic methodology to work out estimates of what might happen in each constituent sector of the economy. The emphasis is to ensure that the assumptions are clearly stated and documented so that subsequent revisions can be effected, once more data is available.

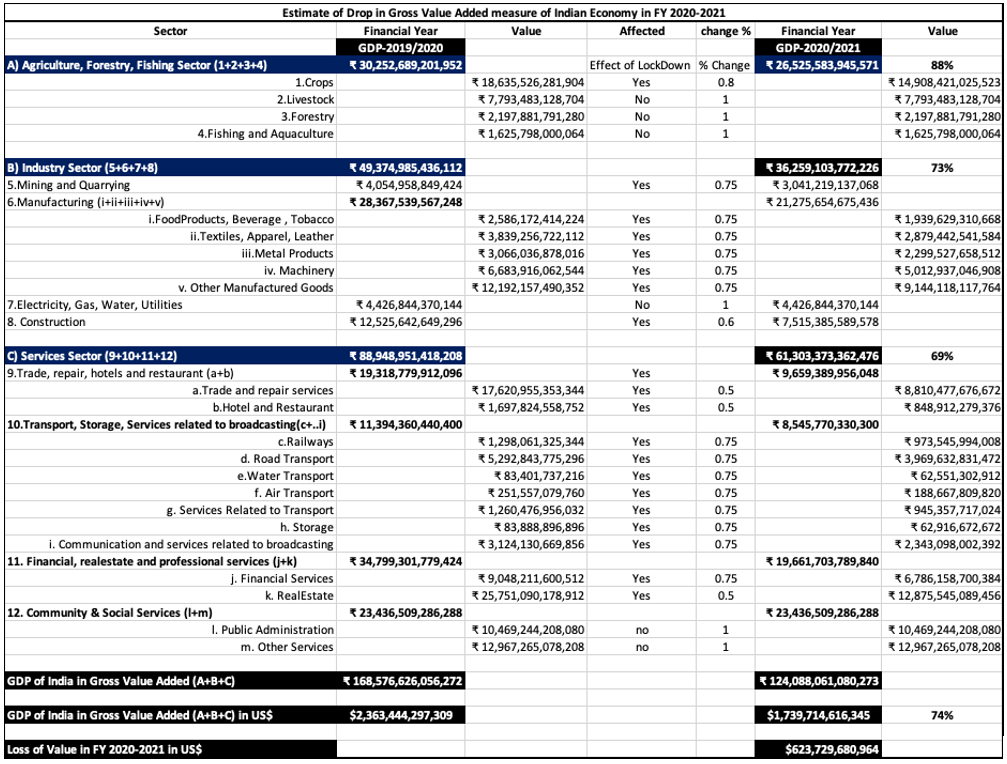

The Lockdown in the Indian Economy was declared on March 25, 2020 when the financial year 2019-2020 was nearly over. As the Financial Year (FY) for the Indian Economy starts from April 1, its impact is mainly going to affect the FY 2020-2021. Most of the 2nd quarter of Calendar Year (CY) 2020 (or 1Q of FY 2020-2021) is going to be lost with a cliff-edge drop impact on the GDP. For purposes of simplicity, the authors have considered zero revenue for impacted sectors. Thereafter while several sectors will take many quarters to recover others should be able to pick up the threads unless the pandemic runs amuck causing disastrous levels of death. Given in the following is a construct of the Gross Value Added (GVA) measure of the Indian Economy by considering a sectoral drop percentage in various constituent sectors.

● For the Trade, Repair, Hotels, Tourism and Restaurants sectors, a change factor of 0.5 or 50% has been considered with the GVA drop being 50%.

● Electricity, gas, water and utilities have been considered at 100% representative or minimal impact.

● With transport starting to operate, change in transport is considered at a factor of 0.75, with GVA drop being 25%.

● While agriculture is not expected to be impacted severely there is a lot of loss of value due to the lockdown, considered at a GVA drop of 20%.

While these are armchair affixed factors, within the macroeconomist’s discipline these should and would be based on statistically determined sectoral simulations. The big-ticket conclusions from the given armchair exercise on the effect of a full 3 month lockdown from April to June on an annualized FY 2020-2021 basis, are the following. A word of caution for the readers, that this is a worst case assumption.

GDP Drop 26% Value of US$ 624 Billion

Loss of GVA in Agriculture 12% Value of US$ 52 Billion

Loss of GVA in Industry 27%. Value of US$ 184 Billion

Loss of GVA in Services 31% Value of US$ 388 Billion

The table below lays out the details of calculation behind the aforesaid numbers:

Source: Base Line GDP 2019-2020 constructed based on GDP growth applied to 2016-17 data gathered from following and applying growth rates 2017-18 (8.2%), 2018-19 (7.2%), 2019-20 (5%) & INR = 0.01402 US$:http://statisticstimes.com/economy/sectorwise-gdp-contribution-of-india.php.

It is revealing to compare these estimates to the professional estimates prepared by global financial giants such as Goldman Sachs1, Nomura2 and HSBC3.

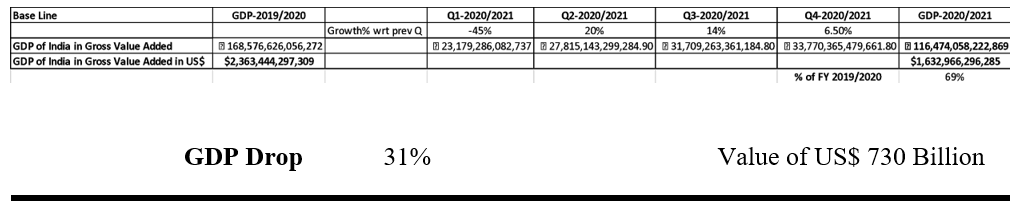

Goldman Sachs:

Goldman Sachs predicts the Indian economy will shrink by 45% on an annualized basis this quarter, and suffer its most severe recession since 1979 this fiscal year, as the coronavirus pandemic wreaks havoc on many of its industries. Their latest quarterly growth forecast, detailed in a May 17 note, is significantly worse than its previous estimate of a 20% decline. On the positive side, its economists expect the Indian economy to rebound 20% in the third quarter, compared to the current quarter. They then anticipate 14% growth in the fourth quarter and 6.5% growth in the first quarter of 2021.

Goldman Sachs’ estimate applied to the authors’ baseline results in the following.

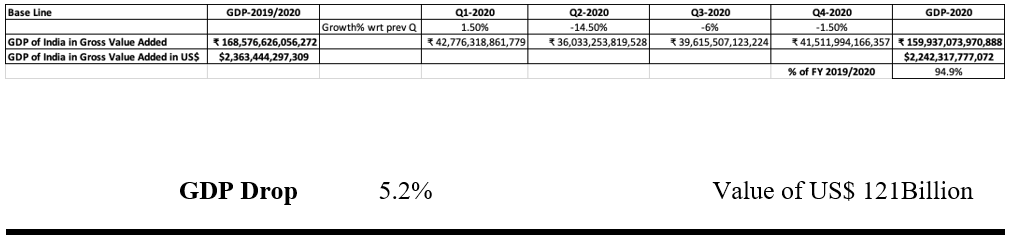

Nomura:

India’s real gross domestic product growth is likely to contract 5.2 percent in the financial year ending March 2021, which lowers its economic outlook amidst an extended lockdown. That is against a contraction of 0.4 percent projected earlier. “We now expect year-on-year growth to remain negative for three consecutive quarters — with growth faltering to 1.5 percent in Q1 (January-March) before plunging to -14.5 percent in Q2 (April-June), and then weakly recovering to -6.0 percent in Q3 (July-September) and -1.5 percent in Q4 (October-December),” the research house said in a statement.

Nomura’s estimate applied to the authors’ baseline results in the following.

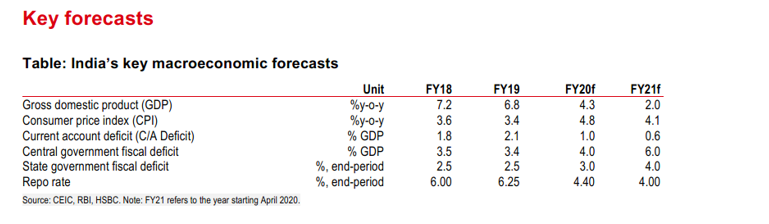

HSBC:

HSBC’s forecast on GDP decline is not available as yet.

The authors sincerely hope that neither theirs nor Goldman Sachs’ estimates come to fruition. While a deep recession spares no one, it is unspeakably hard on the poor and working classes with little savings and reliant on a day to day work for earnings. Below Poverty Line (BPL) population in India was approximately 22% of the population in 2012. It is expected that loss of millions of jobs as a result of the economic contraction is going to increase this number substantively. These are some of the most vulnerable sections of the society mainly from the eastern states of Bihar, UP, Orissa and Bengal (including illegal immigrants from Bangladesh). With employment opportunities mainly concentrated in the Western and Southern states of India, a large number of BPL families travel to these states to take up employment as unskilled and semi-skilled labour in sectors such as construction, quarrying, textiles, jewellery making, hospitality and tourism, to name a few. With hardly any leverage in an oversupplied labour market they continue to remain the most vulnerable and exploited. Since the start of the lockdown, pitiable images of these migrant workers in Delhi, Mumbai, Ahmedabad, Surat have drawn the attention of the world. Due to the cliff-edge drop in economic activity in the earlier named sectors, they have mostly remained unpaid since the start of the lockdown in India from end-March by unscrupulous private sector employers and contractors. On average their earnings are estimated at around Rs 10,000 per worker, a month.

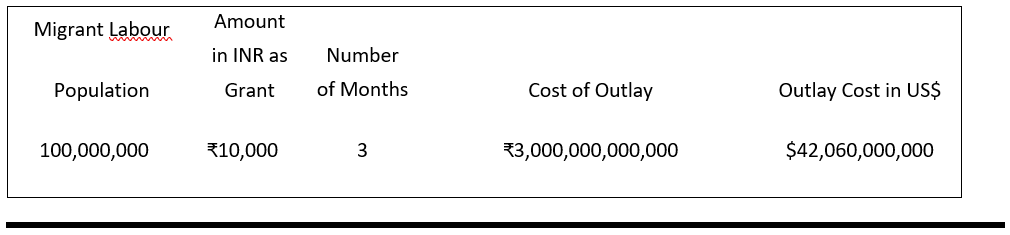

Since early May the government has organized migrant special trains to transport this restive population back to their hometowns and/or to their extended families. As they now return, by end of May their unpaid wages would total 3 months or a full quarter due to no fault of theirs. At a very conservative estimate, they could number (up to a fifth of India’s labour force of over 500 Million) at 100 Million. These workers potentially support family members numbering between 200 to 400 Million or more. A resurgence in the Indian Economy can only happen if India’s migrant labour are nursed, rehabilitated and motivated to join the rebuilding effort. In line with Pandit Deendayal Upadhyay’s principle of Integral Humanism the authors lay a case to propose the provision of a special one time grant, to rehabilitate these affected millions.

A modest grant of ₹10,000 per month for 3 months for 100 million workers is going to cost ₹ 3 lakh crores or US$ 42 billion.

While naysayers will be quick to criticize this as a wasteful “dole” one should also consider it from a humanist prism as a stabilization cost for the society. An unstable society is on a slippery slope of breakdown of law and order. The academic underpinnings of the proposal are anchored in John Maynard Keynes’s Macroeconomic Policy. Keynesian intervention has been successfully used in the past to overcome the 1930’s depression. Fundamentally the macroeconomic equation at any present moment is considered as balance between Aggregate Demand (comprising consumption and investment) and Aggregate Supply (comprising wages, rents, interest and profits). Keynesian macroeconomic policy stipulates that in unprecedented deep recessions boosting the Demand Side of the macroeconomic equation is the only way to kick start the economy.

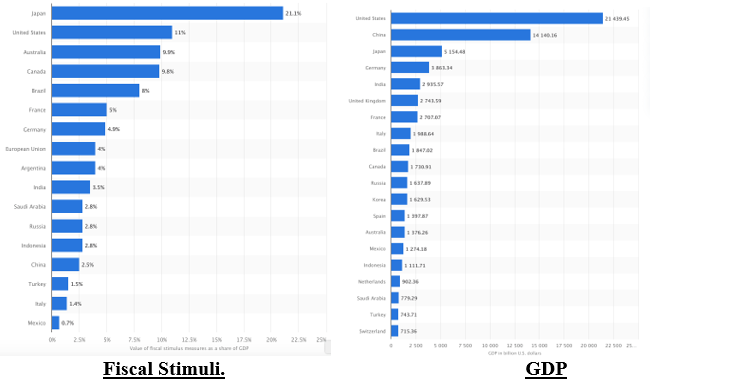

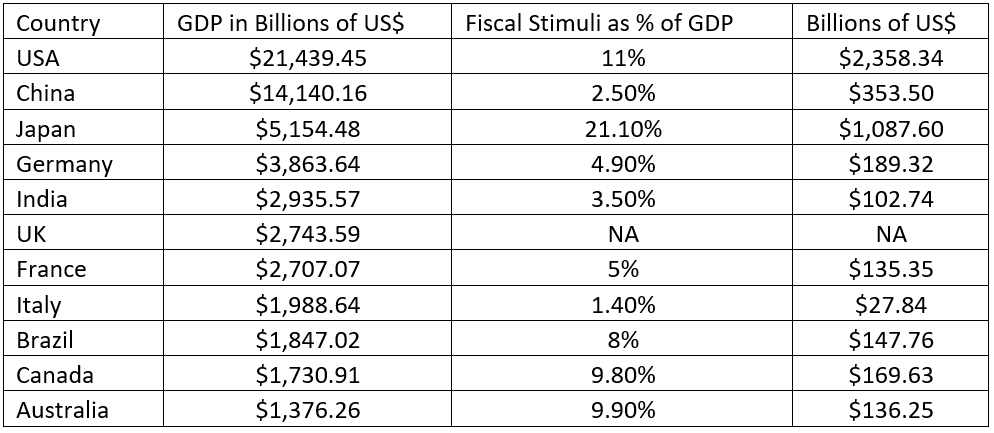

Given below are adjacently placed tables of Fiscal Stimuli and GDP by Country extracted from the website Statista4. Based on the same, the authors have compiled a table of gross value of fiscal stimulus in US$. Out of all G20 countries, Japan has passed the largest fiscal stimulus package that amounts to about 21.1 percent of its gross domestic product (GDP). This package amounts to about 117.1 trillion Yen (1 Trillion US$), and consists of delivering universal cash handouts of ¥100,000 (approximately US$ 930) to every individual in Japan, comprising 126 million people. The USA also has a high fiscal intervention percentage as they did during the 2008 subprime housing-related Economic Crisis.

The Indian government has recently announced a comprehensive stimulus package of ₹20 lakh crore (or 20 trillion) worth approximately $280 Billion Dollars at an old exchange rate of ₹ = 0.01402 US$, estimated to be 10% of GDP. These are a combination of fiscal, monetary and macro-financial measures 5.

The key elements of the fiscal package (3.5%) captured in the earlier table are the following:

• In-kind (food; cooking gas) and cash transfers to lower-income households

• Insurance coverage for workers in the healthcare sector

• Financial sector measures for Micro Small Medium Enterprises (MSME) and Non Banking Finance Companies (NBFC)

• Concessional credit to farmers, as well as a credit facility for street vendors and an expansion of food provision for migrant workers.

The monetary and macro-financial measures are structural in nature mainly comprising of regulatory, liquidity and policy amendments pertaining to RBI. One of the excellent policy decisions of the government is in amending legislation to give freedom to farmers to sell their produce anywhere. The new model Agricultural Produce Market Committee (APMC) Act7 proposes to do away with the concept of notified market area and allow the aforesaid measure. “Over time” such a policy decision is going to lead to increased agricultural revenue and even allow India to emerge as a force to reckon with in international markets as farm based value additive agro-units emerge to take advantage of this supply flexibility. There is a tremendous value and demand for Indian agro-produce such as seasonal fruits and vegetables, amongst the Indian diaspora, but mechanisms for their reliable and assured supply is required.

Structural changes however strategic in nature, affect the supply side macroeconomic equation and usually take time to create an impact.

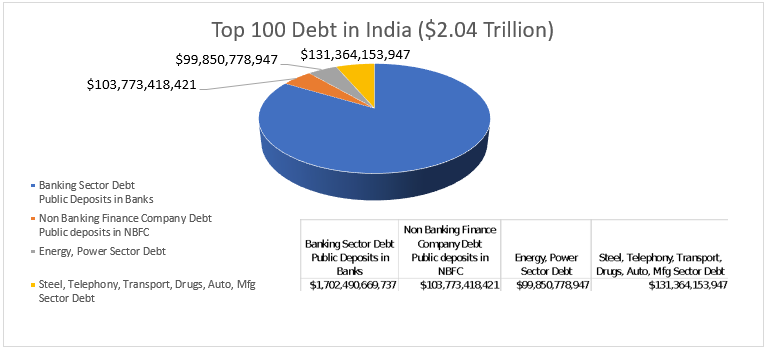

There is a legitimate question in the minds of people as to how the government is going to fund the stimulus even if it is just considered as a medium term (4 year) loan, without controlling runaway inflation. The following is the Debt Status of the top 100 debtors in India (based on their 2019 balance sheet) accessed from Money Control6. Analysis of this suggests that public deposits more than adequately cover outstanding debt:

Banking and Finance Sector Debt actually comprises Public deposits held by these financial institutions. Presuming that the Reserve Bank has done its job professionally regarding oversight on the quantum of advances lent by banks, public deposits more than adequately cover the outstanding debt. It also explains how the government can work on a stimulus using public funds. The government also has various other policy tools such as easing controls on the level of deficit financing and external borrowings to name a couple, which it has been reticent so far in use. The fear has always been about the decline in value of the Rupee and its adverse impact in funding oil imports, but at a time when every country in the world has thrown such caution to the wind and oil prices are at a historic low, there is a compelling case for more direct fiscal stimulus in the form of direct benefit transfer to India’s migrant labour and daily wagers to kick start the Demand side of the macroeconomic equation.

Economic policy to alleviate the immediate effects of COVID 19 needs to be tactical to stabilize society. Strategy has a long term horizon in terms of yield of aspired results. A fine balance of both approaches should serve India well in the times to come. The present government has displayed a commendable commitment to the highest levels of humanism by initiating the lockdown and thus effectively containing a runaway spread of the pandemic. As preparations are made to restart the economy after the effects of the lockdown, stimulating the demand side of the economy is the need of the hour for the security of the country. Augmenting the already announced fiscal measures by providing succour to India’s itinerant labour with an additional one-time distress grant, will enable them to have a fresh start once the economy opens up again. Industry and Businesses also need to share responsibility towards minimising labour migration by offering them food supplies and a minimum allowance to meet their monthly expense. While the mechanism of identification of the recipients of such a benefit is a technical challenge in its own right and merits an in-depth assessment, this is perhaps one policy that will have wide political consensus in the otherwise fractured polity of India.

References:

- https://www.businessinsider.com/goldman-sachs-india-economy-recession-gdp-decline-45-percent-q2-2020-5?r=US&IR=T

- Read more at: https://www.bloombergquint.com/economy-finance/indias-gdp-growth-likely-to-contract-52-in-fy21-says-nomura Copyright © BloombergQuint

- HSBC Global Research’s -India-Covid Impact in charts, authored by Ms.Pranjul Bhandari et al. dated April 30, 2020

- https://www.statista.com/statistics/1107572/covid-19-value-g20-stimulus-packages-share-gdp/#statisticContainer.

- https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19#I

- https://www.moneycontrol.com/promo/mc_interstitial_dfp.php?size=1280×540

About the Authors:

Bhaskar Mukherjee is a Chemical Engineer with over 34 years’ experience in the Oil, Gas and Chemicals Business, based in UK.

Professor Sunil Poshakwale is Professor of International Finance, School of Management, Cranfield University, England.

Image Credit: https://pixabay.com/photos/cash-currency-financial-investment-3829601/